Three Top Tips for eBay Selling

&

Three Top Tips for Garage Sales

- Garage Sale Create Outstanding Ebay Auctions 8 0 50

- Garage Sale Create Outstanding Ebay Auctions 8 0 5 0

- Garage Sale Create Outstanding Ebay Auctions 8 0 5 Months

Once again I got to do a fun field study of garage sale vs. eBay selling. We worked like dogs for 3 1⁄2 days to do the garage sale. We also worked about 15 hours to list 100 things on eBay during that same 3 1⁄2 day period. The results will be posted at the end of this article. What is your guess as to the winner?

- Five-day auction: A five-day auction gives you two days more than a three-day auction and two days less than a seven-day auction. That's about the size of it. If you just want an extended weekend auction or your item is a hot one, use it. Five-day auctions are useful during holiday rushes, when gift-buying is the main reason for bidding.

- 5.0 out of 5 stars. Get Started Making Money on Ebay and Create a Second Income. 101 Items To Sell On Ebay: How to Make Money Selling Garage Sale & Thrift Sto.

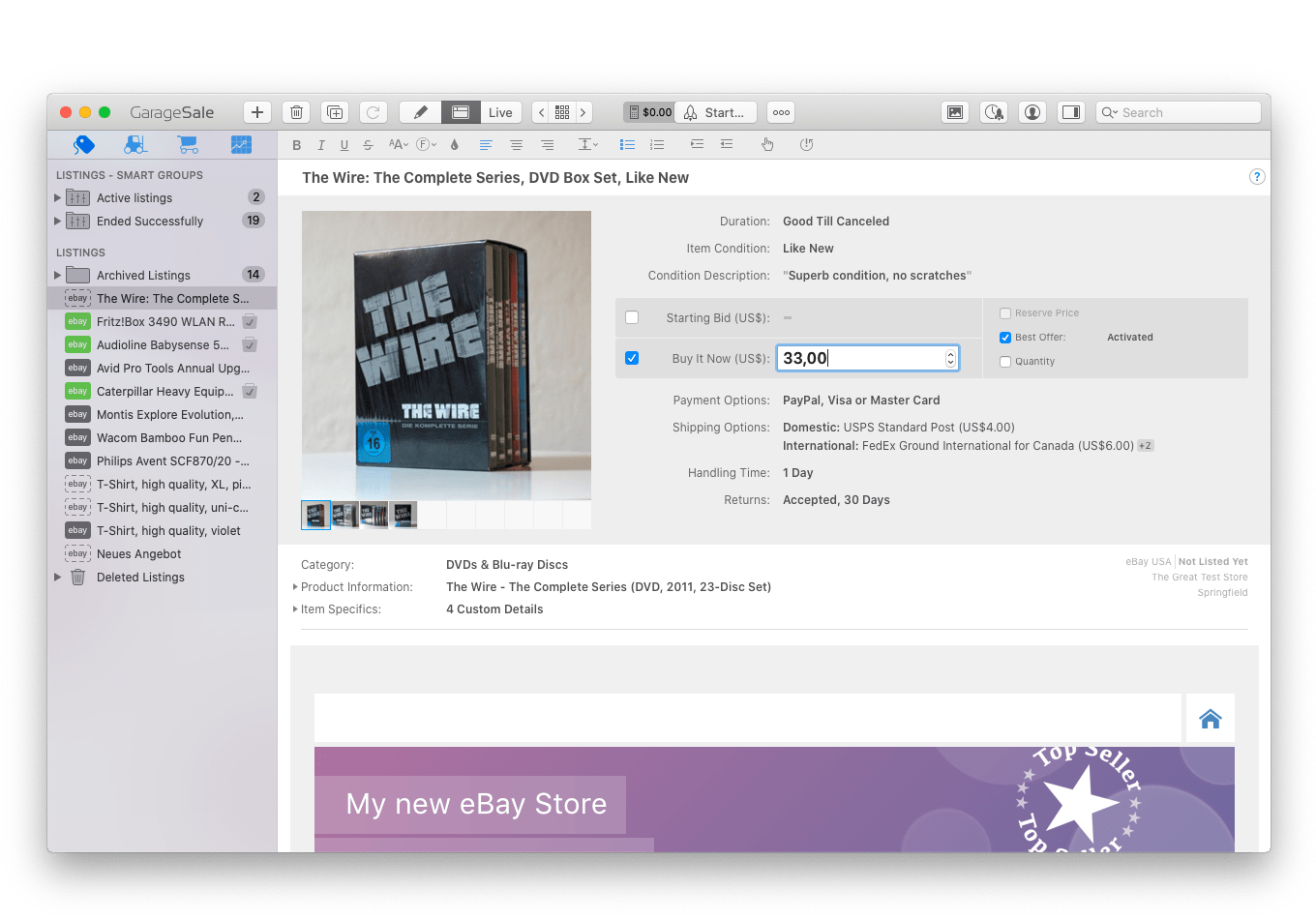

- The default 'Made with GarageSale' footer, the design templates and image links in GarageSale 7.0.9 and higher have been updated and are compliant to all eBay policies. If not done already, please also see our blog post here: GarageSale 7.0.9 supports eBay's new Link Policy.

The default 'Made with GarageSale' footer, the design templates and image links in GarageSale 7.0.9 and higher have been updated and are compliant to all eBay policies. If not done already, please also see our blog post here: GarageSale 7.0.9 supports eBay's new Link Policy. My refurbished 1948 Klipschorn was initially advertised on eBay as a BuyItNow item priced at $15,000 obo. That ad was cancelled yesterday and a new Auction ad was posted. The starting bid of $1,500 has already been entered. Thanks for looking and allowing me to post about it on the Klipsch Commun.

You know that I am NOT a big proponent of garage sales. However, there are some times in your life when a garage sale makes sense. Not a lot of times, but some times. For my sister, a garage sale on July 2nd made sense. We will also be holding garage (actually yard sales) on August 6th and August 20th on King Street in Bellingham, Washington. We will have many more items, furniture and as you know what I always say, 'No one can know everything.' So you can pick up some great deals and make money selling on-line.

And in my experience, yard sales are a blast when you get family and friends involved! Here are me, my brother, my sister and our really good friends Susan and Teresa Thornberg who lived across the street from us while growing up.

When you go through your items and decide what to sell at a garage sale or on-line, I have some tips for you. After you have figured out what should be garage sale vs. eBay, I have some great garage sale tips for you.

My Three Top Tips for eBay Selling

1. Name brand research

If you have something that is in great condition, all the pieces are there, and it is a name brand, I highly suggest doing your research. My favorite tools are Terapeak, eBay, PriceMiner and WorthPoint.

Here is an example of a brand new item with tags that I researched on Terapeak and decided it would be much more advantageous to list on eBay than put out at a garage sale, hoping to get $5 or $10. As you can see from the sales results, we did much better with it on eBay than at a yard sale.

2. Gut Feeling

When I was sorting items, this picture frame seemed to speak to me. Don't really know what that means other than I had a gut feeling about it. It felt heavy, very much a quality item and it was signed from 1995. I am so glad I chose to put it on eBay instead of selling it at a garage sale for $1 to $2. Sometimes you have to trust your instincts. Actually, most of the time you need to trust your instincts!

3. The Smaller the Better for eBay

One of the items that I had to decide whether to sell at online auction or at the garage sale was this extremely intricate racecar set. It was in impeccable condition and was super cool! I did my research and realized it was a $230 item when sold brand new on the Internet.

However, I knew that it would probably take me 1-2 hours to pack it safely for shipment. I decided to put it out at the garage sale for $75 with a make offer sign. Well, it didn't sell at the sale. Darn it! I listed it on eBay and it sold for more than that (we even added a video to the listing) so please check it out.

However, it did take me an hour to pack it. In retrospect, I should have put it out at the garage sale for $50 and also added the Or Best Offer to the price tag. It would have saved me an hour (at least) of heartache and listing time .

My Three Top Tips for Garage Sales

1. Tables, Tables, Tables and Clothing Racks

For my sister's sale we borrowed tables from everyone we knew. Thank you to Jen & Jeff, my dad, my mom, Kay, John & Audrey, and numerous other friends. The more tables you have, the better your items look. No one wants to be digging on the ground at a garage sale for items. Especially as it rains almost every other day in Bellingham. You should also use a clothing rolling rack if you have one or can borrow one. Your items must be presented professionally.

Please also note that our items were placed by category. We had a table of collectors' plates, a table of clothing, a table of lamp parts, a table of books, a clothing area etc. etc.

2. Everything MUST be priced–although Zach loves 'Make Offer'

My nephew Zach (Kiki's 5 year old) is so darn smart. He actually freaks me out. He can read better than I can! In any event, he was helping me price and he loved the 'make offer' tags. My mom had bought about 10 of those pre-priced sticker sets (great tip here as they save a lot of time).

Here is a photo of my pricing table taken when my 5-year-old nephew Zach absconded with my camera. Notice the pre-priced stickers, the diet coke can and the Beanie Baby (that isn't worth anything )

We did put a price tag on every single item, but did make a sign for our blanket pricing of clothing, books etc. This saves time also. Please read below about our price sign and twirlers.

However, we did put two 'Make offer' stickers on two pieces of expensive furniture. It really helped us in the long run. It is almost like throwing an item on eBay and waiting to see what the market will bear or will bid it up to.

My sister had three expensive display cabinets she wanted to sell. We knew that her lawyer's bookcase was worth about $750 so we put that price on it. The other two display cabinets we weren't sure. I thought they were also worth about $750 each. I was wrong. Really, does that ever happen? Apparently it does!

Well, with the 'make offer' stickers we didn't make fools out of ourselves (a good thing). Three local antique dealers looked at the two cabinets and all three said that each cabinet was worth about $250. So, we finally put a price of $300 on each one. We actually were able to sell one of them to a former customer of Leaf's antiques for $250 and my sister and I were so happy it was going to a great home.

3. Signage, Twirlers, Craigslist & Local Newspaper Ads

Signs were posted all over my sister's sale with these blanket prices (saved us from pricing every single item individually):

Here is a photo of the backside of one of the big signs.

- Hardback books $1.00 each

- Paperback books 50 cents each

- Lamp shades $5.00 each

- Collector's plates $3.00 each

- Shoes $1.00 a pair

- Sweaters, dresses and jackets $2.00 each

- All other clothing $1.00 each

- Socks 50 cents a pair

- Videos $1.00 each

Then please make sure that you post a great ad on craisglist (it is free), also post a short newspaper ad in your local paper with a 'Please see craisglist ad for more info' (this does cost money) and post signs all over your neighborhood with arrows pointing in the right direction.

Finally, twirlers are an awesome idea! We found that around noon time our traffic stopped. We got all the kids (age 11 and older) that were there helping to make more signs and go to the busiest closest intersections and twirl their signs. Cracked me up but really drove traffic!

Here is a photo of our twirlers.

Happy Garage Selling & eBaying!

Lynn

www.thequeenofauctions.com

How does eBay for Charity work?

eBay for Charity has partnered with the PayPal Giving Fund to make it easy for sellers to donate 10% to 100% (or as low as 1% for eBay Motors vehicles) of your item's final sale price to a certified charity.

It's as easy as 1 - 2 - 3!

- Seller picks the charity and the donation percentage when listing an item

- SELL & SHIP

- Buyer pays full amount to seller

- After the transaction is complete (approx 21 days), PayPal Giving Fund will automatically collect the donation from the seller's PayPal account*

- Once a month PayPal Giving Fund will combine and deliver 100% of all donations collected for that charity

*If your donation cannot be collected automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation.

Are you an employee or authorized agent of a charity?

If you are listing items on eBay directly for a charity, such as you are an employee or a authorized agent of the charity, you should take an extra step and designate yourself as a 'Direct Seller' in our system. After you do so, when you list an item for your charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. To become a Direct Seller, you will need to ask the charity administrator to add your account to their Direct Seller list. Learn more about getting your account set up as a Direct Seller.

Are you a standard seller on eBay?

If you don't work on behalf of a charity, all you need to do is add the charity and donation percentage to your listing and after the item sells and the buyer pays, the system will automatically collect your donation through our charity partner, the PayPal Giving Fund. Pdf reader 1 57. PayPal Giving Fund will email you with a donation receipt. Then, once per month, the PayPal Giving Fund consolidates all the donations collected for that charity in a single payment.

If you are a managed payments seller, payouts are directly issued to your bank account on daily or weekly basis. The payout schedule can be managed through Seller Hub.

What are the benefits to selling for charity?

I'm listing items on behalf of a charity. Do I need to do anything differently?

If you are listing items on eBay on behalf of a charity, either as an employee or a authorized agent, you are considered a 'Direct Seller'. When you list an item and select that charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. Make sure that the charity administrator adds your account to their Direct Seller list. Learn more about getting your account set up as a Direct Seller.

What is the PayPal Giving Fund?

PayPal Giving Fund (PPGF) is a registered non-profit that connects donors, businesses & charities in order to help charities raise new funds. eBay for Charity works directly with the PayPal Giving Fund to enable sellers to donate a portion of their sales and buyers to shop while supporting their favorite charity. It's a win-win-win opportunity!

Thanks to operating support from PayPal, 100% of every donation processed by PayPal Giving Fund reaches the donor's chosen charity organization. And because PayPal Giving Fund is a nonprofit itself, 100% of your donation amount is tax deductible to the extent allowed by law.

PayPal Giving Fund also certifies the charity, provides donation and donor reports, issues tax receipts, aggregates donations for monthly electronic distribution, and handles legal registration requirements. Learn more about PayPal Giving Fund.

1. SELECT CHARITY

How do I add charity to my listings?

*The charity you select will be notified of your listing according to its account preferences and has the right to request an item cancellation if it prefers not to benefit from your listing.

Garage Sale Create Outstanding Ebay Auctions 8 0 50

How do charity listing fee credits work?

When you create a listing with eBay for Charity and that item sells, eBay will credit the Insertion and Final Value Fees back to you, equal to the percentage of the final sale price that you elected to donate. Here's an example:

Auction Starting Price = $10

Shipping = $10

Final Sale Price = $100

Total Amount of Sale = $110

Insertion Fee = $0.30

Final Value Fee = $10

Final Value Fee on Shipping = $1

Total Basic Selling Fees = $11.30

Elected Donation Percentage = 50%

Insertion Fee Credit = 50% x $0.30 = $0.15

Final Value Fee Credit = 50% x $10 = $5

Final Value Fee on Shipping Credit = 50% x $1 = $0.50

Total Basic Selling Fees Credited = $5.65

If you are a managed payments seller, eBay will provide a discount on the Final Value Fee and insertion fees, up to a maximum of 70%. Here's an example:

Total Amount of Sale = $110*

Final Value Fee = $11*

Elected Donation Percentage = 80%

Charity Discount Applied = 70% of $11 = $7.70

Final Value Fee (Per order fixed fee) = $0.30

Total Fee = $11 - $7.70 + $0.30 = $3.60

There will be no additional third party payment processing fees.

*For complete details of seller payment fees, please refer to managed payments Terms of Use.

Note: Other credits may be issued for impacted sellers in Service Metrics with a ‘Very High' rating for Item Not as Described returns. See Service Metrics Policy for more information.

Are Insertion or Advanced Upgrade fees charged for charity listings?

Yes, Insertion and Advanced Upgrade fees will be charged for charity listings even if the item does not sell. However, for those listings that sell, we'll credit the Insertion and Final Value fees equal to the percentage you donate. For example, donate 50% of your listing proceeds toward the charity listed and you will get 50% of the Insertion and Final Value fees credited. Advanced listing upgrade fees aren't included in these credits. Learn more about selling fees.

https://cooltup909.weebly.com/free-casino-slots-games-to-play-for-fun.html. If you are a managed payments seller, eBay will provide a discount on the Final Value fees and Insertion fees, up to a maximum of 70%. There will be no additional third party processing fee.

How do I add, change or remove the charity on my listing?

Garage Sale Create Outstanding Ebay Auctions 8 0 5 0

Use the 'revise listing' tools in the selling section of ebay.com to make changes. Most of the time you can add, change, or remove a charity, or adjust the donation percentage on your active listing as long as it meets the following criteria:

I am unable to change the charity or donation percentage on my item. Why?

You cannot make any changes to the charity or the donation percentage when:

My charity listing was removed. Why?

There are many reasons that a listing might be removed -- see the original email you were sent or contact customer service to find out why. There are two charity-specific reasons that typically apply:

Are there any item or category restrictions for charity listings?

Yes, there are some limitations on what items and categories can be included in an eBay for Charity listing. The 'Mature Audiences' category may not be used, and offering items such as raffle or lottery tickets is prohibited. For a complete list, please go to Rules about Prohibited and Restricted Items.

Also, the nonprofit that you select has the right to request an item cancellation if they prefer not to be associated with your listing.

2. SELL & SHIP

*If your donation cannot be collected automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation.

What should I expect after my charity item has sold?

After your item has sold and you've been paid by the buyer, ship the item as quickly as possible. eBay will schedule the donation payment which you will find on your Donation Account Dashboard. The donation will be collected about 21 days after it sells to ensure that the transaction with the buyer is complete.

Make sure that you have set up a charity payment method.

Your donation payment method is used to collect donations from your completed eBay charity sales. Since donations are paid directly to PayPal Giving Fund for payout to the charity, we recommend using your PayPal account as the donation payment method. In the absence of a PayPal account, we will invoice you for the donation amount, which you can pay through any convenient method of payment.

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

What if the buyer doesn't pay or returns the item?

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

3. DONATE

How and when will my donations be paid to the charity?

Our charity partner, PayPal Giving Fund, automatically collects donations approximately 21 days after your item sells. We recommend that you set your charity payment method as your PayPal account. If your donation cannot be collected automatically, then you will be emailed an invoice from PayPal Giving Fund, requesting payment for the donation. You can pay these invoices with credit card, PayPal, bank card or other supported payment types.

Once successfully collected, you will receive an email indicating that your donation has been collected which is your official tax receipt as well.

The PayPal Giving Fund then combines donations received from eBay sellers from the 16th of the previous month to the 15th of the current month and then delivers a single donation to the charity's PayPal account. For example, if a donation is paid on the 10th of October, the donation will be delivered to the charity at the end of October. However, if a donation is paid on the 20th of October, the donation will be delivered to the charity at the end of November.

Why am I being invoiced from PayPal Giving Fund?

eBay for Charity has partnered with the PayPal Giving Fund to collect donations from eBay sellers and deliver them to the charity. If your donation cannot be collected automatically then you will receive an invoice payable to the PayPal Giving Fund requesting payment for the donations due. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types. You can check to see if you have a charity payment method from your Donation Dashboard on the Settings tab.

I deleted the invoice email from PayPal, how can I pay my invoice?

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

What do I need to do to make sure that my donation can be automatically collected?

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

Why do you wait 21 days to collect my donation? Can I pay it sooner?

We wait 21 days to collect the donations to ensure that the transaction between you and the buyer is completed including payment, shipping, refunds or returns. If the buyer doesn't pay or returns the item then the donation will be canceled.

If you would like to pay your donation sooner, you can do so by requesting an invoice from your Donation Account Dashboard and pay the invoice immediately.

Garage Sale Create Outstanding Ebay Auctions 8 0 5 Months

Can I pay my donation directly to the Charity instead of paying PayPal Giving Fund?

No - please allow our automated systems to collect your donation due. If you pay the charity directly, our systems will think you have outstanding donations due and your account may be restricted from listing items that benefit charity. Also, when paying your donation through the PayPal Giving Fund you receive an official tax receipt. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

What happens if I have not set up a charity payment method yet?

You will receive an invoice from PayPal Giving Fund requesting payment for the donation amount approximately 21 days after your item has sold. You can pay these invoices with credit card, PayPal, bankcard, or other supported payment types. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

If you would like to pay your donation sooner, you can request an invoice from your Donation Account Dashboard.

You can add a charity payment method from your Donation Dashboard on the Settings tab.

How can I change or remove my PayPal account from the charity donation method?

First, check your Charity Donation settings to verify which PayPal account is selected as your charity donation method. You cannot remove the PayPal account but you can add or change your charity payment method from your Donation Dashboard on the Settings tab.

Where can I find a summary of all the donations that I've made?

Free spins gratis. Go to the History tab of your Donation Account where you can select the desired year to see all the donations you made that year. You can export that information into an Excel table if you want to save or print the yearly summary for your records.

How do I cancel a Charity Donation or Invoice?

When you add a donation to a listing, you are required to pay that donation to the charity. In the rare instance that you would like to cancel a donation or invoice. You can do so by signing into your Donation Account and following the instructions below.

- If you are cancelling a donation that has not been invoiced, you can do so by visiting the Pending Donations tab within your Donation Account Dashboard. There you will see the donations eligible for cancelling.

- Click or tap the 'Request Cancellation' button and complete the online form.

Once the donation cancellation is complete, you can view your cancelled donation from the History tab in your Donation Account Dashboard.

Once a pending donation is cancelled, you will not receive an invoice or get charged for the donation amount.

How do I cancel a Charity Donation that has already been invoiced?

- If you are cancelling a donation that has been invoiced, you can do so by visiting the Invoiced Donations tab within your Donation Account Dashboard. There you'll see the Invoices eligible for cancelling.

- Click or tap the 'Request Cancellation' button and complete the online form.

Once the cancellation is complete, you'll be able to view your cancelled Invoice from the History tab in your Donation Account Dashboard, and you will not be required to pay the invoice.

How many times can I submit a donation cancellation request?

When you add a donation to a listing, you are required to pay the donation. Users can make up to two cancellation requests. If you need to make additional cancellation requests, please reach out to our customer service team at 866-305-3229 in the US or 0345 350 3229 in the UK.